+44 75754 30035 help@rapidassignmenthelp.co.uk

offer

🎁Special Offer 🎁 Discounts - Up to 55% OFF!

🎁Special Offer 🎁 Discounts - Up to 55% OFF!

Get free samples written by our Top-Notch subject experts for taking Assignment Help Online services in UK.

Preparatory report

Health and social care organizations are an important and priceless component of a country and require the proper maintenance and guidance for their growth. The financial aspect operates the organizations, and its proper management and health and social care sectors are required to be involved in the account and finance management. Managing the finance and accounts is required for healthcare and social care organizations to care for patients. According to Cadogan and Hughes (2021), financial and accounts management is required to provide proper and required care and treatment to patients admitted to hospitals and social care settings. The hospitals must make amendments and action plans to help them manage their finances and accounts.

Managing finances and accounts are necessary for hospitals and social care settings to maintain their operations and services. Organizations can operate with the proper and robust implementation of finance and accounts management. Proper financial and accounts management is required to recruit healthcare personnel and social care workers to ensure the well-being of patients and individuals in social care settings. As Mosteanu and Faccia (2020) suggested, the management of finances is necessary, which is often done by technological use and is required for the recruitment of personnel to provide service to patients. Financial and accounts management, along with keeping financial expenditure records, is required for the viability and sustainability of any organization, in this case, health and social care organizations.

Managing the finances and accounts is necessary for the sustainability and viability of the organizations. The health and social care sector must manage its finances to ensure proper operations management and increase its patient services. To ensure finances and accounts, organizations are often involved in employing financial software services for accounts management. Sage Intacct is a financial software health and social care organizations utilize to manage finances and accounts. According to Moll and Yigitbasioglu (2019), financial software such as Sage Intacct is required to calculate the revenue generated and analyze the previous records to summarise the pattern of the financial status of the organizations. Financial software is required to generate billings and invoices to record revenue-generating profit and loss.

Financial software has become necessary for their easy-to-use prospect and efficiency. Hospitals and healthcare settings are required to manage their finances and accounts to analyze their progress on a day-to-day basis. Financial software helps create charts, graphs and comparative data, which is helpful for the analysis of the pattern of the financial prospects of the organizations. As opined by Greenhalgh et al. (2018), financial software is required to keep track of the business proceedings and revenue generation of the organizations. The utilization of software tools is also required for the maintenance and abiding with tax compliance. Organizations must maintain tax records to ensure their sustainability and viability.

Hospitals and social care settings must maintain their accounts and finances for sustainability and growth. These organizations are often involved in utilizing services of financial software to keep records and analyze them. Managing the finances is required, and they are done based on financial ratios. Health and social care organizations are involved in financial ratios for accounts management and follow the cash-flow coverage ratio. As opined by Kadim et al. (2020), hospitals depend on the cash flow and liquidity required for the operations of the hospital's social care homes. Hospitals depend on cash flow and financial reimbursement from insurance companies, which comes from various insurance companies and government agencies. Health and social care organizations depend on the huge and sufficient cash flow to give proper care and treatment to the patients and ensure their financial survival in the health sector market.

The operations, especially financial operations, depend on various financial ratios, ensuring the financial organizations' survival. Health and social care organizations must maintain their financial and account records by following these ratios. The financial ratio followed by these organizations is the operating margin ratio which is helpful in the management of financial and accounts operations. As stated by Olga et al. (2020), operating margin comes under the profitability ratios, which define the amount of profit made by the organizations by selling their products and services after deducting production and operating expenses. Operating margin is the key financial ratio for health and social care organizations to determine potential earnings and thus evaluate their growth potential in finance. This ratio also gives an insight into the organization's management of operations and finances for its growth and development.

The management of finances is required for health and social care organizations based on key financial ratios. The business undertaken by the health and social care organizations is based on the long term and short term, which helps in revenue generation. The long-term business involved in the hospital setting is mainly medicines, medical equipment sales and online healthcare services, also known as teleservices. According to Nyashanu et al. (2020), the advent of the pandemic, COVID-19 has led to an increase in dependency on teleservices in which doctors and healthcare professionals are providing their advice and service through the use of technological means. Technological means have been helpful and important for ensuring long-term business for healthcare and social care organizations. The selling of medical equipment such as medicines, syringes, catheters, and other equipment is the main tool for the business growth of hospitals. The selling of medicines and medical equipment has led to an increase in revenue generation.

Get assistance from our PROFESSIONAL ASSIGNMENT WRITERS to receive 100% assured AI-free and high-quality documents on time, ensuring an A+ grade in all subjects.

Health and social care organizations are also involved in a short-term business setting, contributing to their finances. The short-term business for the health and social care organizations are nutrition advisory services and rehabilitation services, which include drug rehabilitation. As stated by Fana et al. (2020), short-term business ideas are implemented by social care sectors for the generation of revenue and to increase their financial status. Social care organizations are involved in providing advisory services like nutrition and rehabilitation, which help in the improvement of the lifestyle of individuals. Short-term business is helpful as it establishes the financial prospects of these organizations.

The availability of finances is necessary for the sustainability and viability of the organizations, in this case, health and social care. The availability of finances comes with the issue of benefits and limitations for health and social care organizations. The benefits of the availability of finances help in the recruitment of the healthcare professionals like doctors, nurses and caregivers in hospitals and social care settings. According to Comas-Herrera et al. (2020), the availability of finances benefits the health and social care settings, which helps recruit healthcare personnel. The recruitment of healthcare care personnel needs to be done to provide treatment and care to patients and individuals in health and social care organizations.

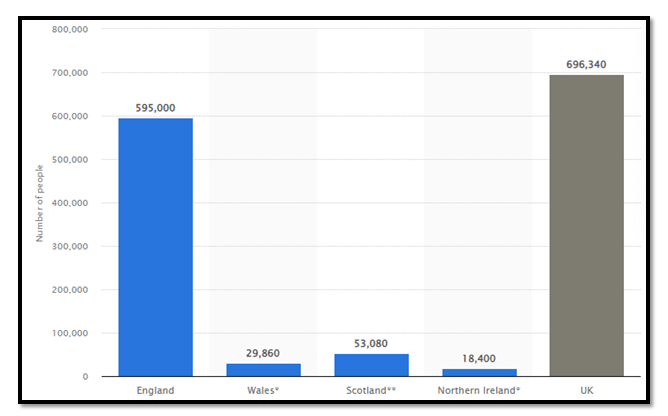

Figure 1: Number of employees in the social care sector in the UK

Figure 1 shows the number of employees in the social care sector in the UK. The availability of finances is associated with benefits and limitations. The limitations of the finances hamper the operations of the healthcare and corporate sector. As Sherman et al. (2021) suggested, the main limitation in the availability of finances is the inability to acquire medical equipment to treat patients. Treating patients suffering from complex diseases are often limited due to the limitations of the finances to acquire modern medical equipment. The limitations of the available finances need to be overcome to ensure the proper treatment of the patients.

Health and social care organizations must manage their finances and account for their viability and sustainability. Organizations must manage their budget and revenue to run operations and sustain in the open market. Healthcare and social care organizations must manage their budget for treating their patients and giving them quality care (Ruwanti et al., 2019). The budget allocation is required to acquire medical equipment, tools, and medicines for the treatment of the patients. The availability of finances is also necessary for the recruitment of healthcare professionals.

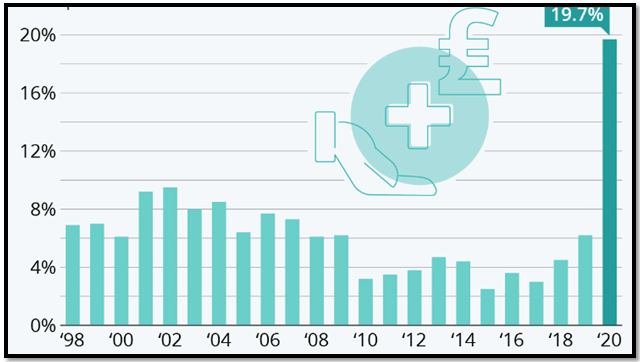

Figure 2: Expenditure in the UK healthcare sector from 1998 to 2020

Figure 2 shows the expenditure increase from 1998 to 2020 in the health sector of the UK. Budget allocation and management are required for the running of the operations of hospitals. As for Midlands Metropolitan University hospital, for the year 2021/22, 878,808 pounds is the total expenses, and this is required for the treatment of patients along with medical equipment acquirement (refer to appendix 1). The budget allocation is required for the treatment of patients, rehabilitation purposes and the acquirement of equipment.

Double-entry bookkeeping is done by recording transitions between debit and credit. This method is required to keep records of finance and helps in financial management. Financial management is required for hospitals and social care to treat patients and individuals admitted in hospitals and social care settings. The financial aspect operates the organizations, and its proper management and health and social care sectors are required to be involved in the account and finance management. Managing the finance and accounts is required for healthcare and social care organizations to care for patients. Management of finances is necessary, often done by technological use and is required to recruit personnel to provide service to patients. Financial and accounts management, along with keeping financial expenditure records, is required for the viability and sustainability of any organization, in this case, health and social care organizations.

Business Report

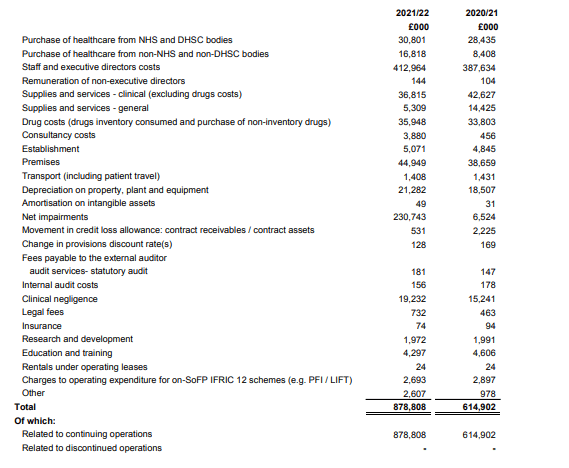

The above table has illustrated the organizational budget of the concerned healthcare and it is highlighting the entire expenses of this organization in a year between 2020 to 2022. In addition, Midland Metropolitan University Hospital is providing high-quality treatment and palliative care to its patients and it is helping the concerned organization in terms of increasing its profit rate gradually. In the case of this concerned organization, as it is providing high-quality care hence, this organization is required to increase their expenses. As opined by Finkler et al. (2022), maintaining a proper organizational budget is effective and beneficial in terms of improving working culture and organizational profitability rate in a proper way. In addition, maintaining an organizational budget is necessary for this concerned organization as it is helping to increase the profit rate gradually. Similarly, as stated by Shapiro and Hanouna, (2019), budgeting is an essential procedure as it is overseeing and preparing the financial document of an organization and it is estimating the expenses and income for a sudden period. For instance, for the managers, owners and executives of concerned healthcare organizations, budgeting is a major skill to have. Additionally, it ensures the team and organization for having a huge capital resource for executing the initiatives and achieving the desired goals.

This healthcare organization is installing several kinds of innovative technologies in terms of providing high-quality palliative care to patients to overcome their critical health issues. The above table has discussed the operating expenses of Midland Metropolitan University Hospital and it is helping to gather knowledge about the expenses and income of this organization. Between the year of 2020 to 2021 and 2021 to 2022, the amount of total continuing and discontinuing operations are around 878,808 Euros and 614,902 Euros, respectively. In addition, the net impairments of this company in those mentioned years are 230,743 Euros and 6,524 Euros accordingly. Moreover, the charge of audit services is nearly 531 Euros in 2022 and 2225 Euros in 2021. This report has shown that in the year of 2022 is lower than in 2021; hence, it has been evaluated that the number of expenses has decreased gradually. Hence, it is helping to increase the organizational profit rate and increasing the company's assets in every year.

On the other hand, the above table has highlighted the legal fees, internal cost of audit and insurance. In addition to that, the charges for training and education which are provided to the healthcare employees are mentioned in that table. As a result, it is assisting the organization in maintaining a proper monthly budget and reducing extra expenses (Brigham and Houston, 2021). Henceforth, it is supporting the organization to create a standard organizational budget and decrease the rate of excess expenses. Providing proper treatment and care education to healthcare employees is helpful in increasing expenses. Hence, this organization is required in terms of maintaining a proper monthly budget and reducing extra expenses.

The necessity of investment appraisal is that it is assisting the healthcare providers as it is analyzing the organization's budget. In addition, it is able to maintain track of this concerned organization and it has a best potential depending upon the profit rate. Moreover, it is helping the organization is maximizing the profit rate endeavours and future aspects. There are several kinds of techniques regarding Investment Appraisal and those are providing a proper justification and rationale to spend limited resources and it is relying on robust investment appraisal (Grable et al. 2020). Investment appraisal techniques such as Net Present Value, Internal Rate of Return and Payback Period are applied in terms of evaluating the capital expenditure and investigating the provided projects. All those investment appraisal techniques are applicable and essential for Midland Metropolitan University Hospital in terms of determining whether the investment amount is able to make a profit or loss. As opined by Baum et al. (2021), the payback period is addressed as a period which represents the required time for developing a project in terms of recovering the cost of investment. In addition, it is anticipated that the amount of investment able to reach Break Even Point. Additionally, it is occurring while the amount is equal to the initial capital which is invested and generated for the concerned project.

Apart from that, the Net Present Value procedure is taking the time and money value into account. In addition, it is analyzing the rate of profit of this concerned organization. Henceforth, this specific appraisal technique is beneficial in maintaining the profitability rate and reducing extra expenses. As stated by Chang et al. (2020), the NPV method is analyzing the profit rate for developing a project and finds the present value for the upcoming cash flows for a sudden period of time. Additionally, it deducts the investment amount from the initial investment cash. The formula of NPV is highlighted below:

"NPV= Present value of future cash flows – Initial cash investment" a positive NPV is indicating that the project is generating the entire profit rate. In case the NPV rate is becoming negative, then it is giving the scenario of vice versa. For this reason, it has been evaluated that it is safe not to pursue the investment or project option. On the other hand, as expressed by Kuo, (2019), the Internal Rate of Return is addressed as an annual earning accounting for the Net Income as the investment percentage. In addition, the major level of positive IRR is varying according to organizational activities. Moreover, all the investors are accepting the projects in case the IRR is the higher required rate and vice versa (Al Breiki and Nobanee, 2019). As a result, while comparing those two different projects, the first one is aligning with IRR and it helps in achieving desired goals.

Example of Investment Appraisal

Considering all the examples of investment appraisal of a project and expenditure of Midland Metropolitan University Hospital is better in terms of understanding all practical applications of those mentioned appraisal techniques. As stated by Alkaabi and Nobanee, (2019, b), the values or the specialists are employing the discounted methodologies of cash flow in terms of estimating the worth of the specific project. Additionally, it contains the components of discounting the future, like Investment Income and Costs for accounting for money value. As a result, the entire procedure of valuation aims to estimate all factors, such as investment value, selling price and project purchase price. In a similar way, as depicted by Mirnenko et al. (2020), the entire procedure of investment appraisal techniques is essential in decreasing the rate of expenses and increasing the rate of profitability in a proper way. In this regard, this evaluation procedure is providing an opportunity for understanding the situation about whether the organization is making a profit or loss. After discussing the entire investment procedure, the outcome has evaluated identifying the marketers who are under or expensive (Richardson, 2019). Additionally, those are influencing the investors and business participants to invest a proper amount in developing a project or evaluating the expenditure.

Managing financial activities in a healthcare organization is that, it is helping to plan financial statements in a proper way. In addition, it is assisting the organization in managing and acquiring sufficient funding resources and it is providing as insight to the organization for making critical and effective decisions regarding organizational activities and improvements. Several kinds of recommendations are suggested to the concerned organization in terms of improving the business activities and those are highlighted below:

References

Books

Figure : Annual report 2022/21

Task A : Globalisation Factors and Business Impact This Level 5: Unit 25 Global Business Environment Assignment is a perfect...View and Download

Introduction Organisational culture means a set of values, beliefs, systems and rules that influence the behaviour of customers....View and Download

Introduction to Occupational Risks Prevention Assignment The purpose of this work is to propose the creation of a new...View and Download

Introduction This assessment entails the completion of two tasks and an Appendix, which have to be compiled and submitted...View and Download

Johnson's Mazda Oxford: Innovation, Sustainability & Growth Johnsons Mazda Oxford is thus a symbol of the technological...View and Download

Introduction to Polymerase Chain Reaction and Its Role in Disease Assignment Polymerase chain reaction” is a highly...View and Download