Take the stress out of your academic journey with our professional Assignment Help, tailored to meet your specific requirements.

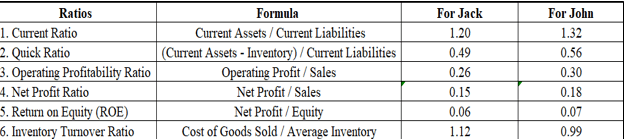

Figure 1: Calculation of Ratios

Current Ratio

Jack claims that their current ratio is 1.20, indicating that they have £1.20 in present assets for every £1 in contemporary deficits. The current ratio measures a company's capacity to meet its short-term commitments with its short-term investments. John has a slightly higher current ratio of 1.32. Both companies have now ratios that are greater than 1, demonstrating that they can meet their immediate obligations. A ratio greater than 1 indicates that a business can fulfil its attendance assurances.

Get assistance from our PROFESSIONAL ASSIGNMENT WRITERS to receive 100% assured AI-free and high-quality documents on time, ensuring an A+ grade in all subjects.

Quick Ratio

The procedure takes into account a company's ability to use its various liquid aids to satisfy its immediate responsibilities. The quick ratio for both companies is below 1, which indicates that, if inventories were omitted, they could have problems meeting their immediate obligations. As cited by Perton et al. (2020), the quick ratio sometimes referred to as the ratio, is a more conservative indication of liquidity because inventories are not included in it. John has a quick ratio of 0.56 whereas Jack has a quick ratio of 0.49 for the financial year 2021.

Operating Profitability Ratio

John's operational profit margin is somewhat higher, showing that his staff members are more successful at making a profit from their work. As per the narration and explanation of Pasaribu et al. (2018), the operating ratio of profitability, also known as the operating margin of profit, measures how well a company makes profits via its operational activities. Jack and John had operating profitability ratios of 0.26 and 0.30, respectively in 2021.

Net Profit Ratio

The NPM ratio measures how profitable a business is after all costs, including the cost of interest and taxes, have been incurred. Jack's net profit ratio is 0.15, or 15%, whereas John's is 0.18, or 18%. Since John's NPM is higher, it is possible that they retain more of the revenue they make as profit after all expenses.

Return on Equity

ROE assesses a company's ability to provide a monetary return for its owners based on the total amount of equity invested in the business. For the fiscal year 2021, Jack's ROE is 0.06 and John's is 0.07, indicating net profit margin and shareholder equity. Both companies have positive ROEs, demonstrating that they are both providing shareholders with profitable returns (Alaica et al. 2019). John has a somewhat better ROE, indicating that he is more successful at converting equity into profits.

Inventory Turnover Ratio

John's inventory turnover ratio is 0.99, but Jack's is 1.12, indicating that they are able to more successfully manage their stockpiles by trading and replenishing them more regularly. As stated by Ramadiani et al. (2019), the common ratio, which is derived by dividing intermediate inventory by the cost of commodities sold, is a key indicator of how successful a business is in managing its holdings. The cost of products sold is divided by the median amount of stock to arrive at the rate of turnover of inventory, which assesses how well a business maintains its inventory.;

In 2021, Jack and John both have comparatively sound financial ratios. Incredibly, the critical remember that these statistics give an overview of the firms' financial situation as of 2021. A more complete assessment of their financial conditions should also take industry standards and qualitative elements into account. Their current ratios are both over 1, which indicates strong liquidity. Jack manages his inventory more effectively, as seen by his greater turnover rate of inventory. John's quick ratio is a little bit higher, which may indicate a greater capacity to pay short-term obligations without using inventories.

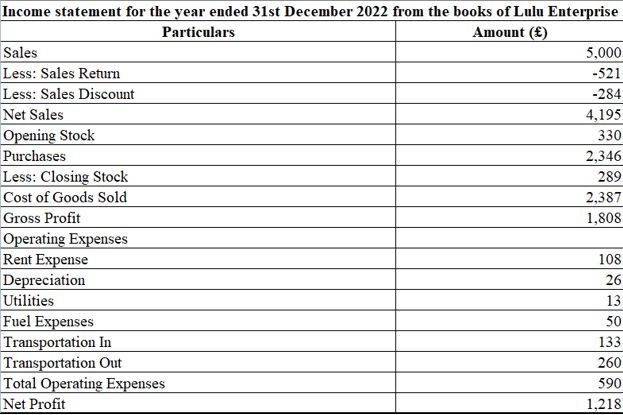

Figure 2: Income Statement

Lulu Enterprise made total sales of £5,000 throughout the course of the year; however, it experienced sales returns of £521, which suggests that some buyers sent back merchandise. The value of the inventories on hand at the start of the year was represented by a starting stock of £330. Net sales totalled £4,195, which represents the money remaining after subtracting returns and discounts. Lulu Enterprise spent a total of £2,346 on products throughout the course of the year. Gross profit is the distinction between net sales and the value of goods sold. The total revenue for Lulu Enterprise was £1,808. Additionally, it displays the company's income, costs, and expenses, with a net profit of £1,218 as a consequence. For evaluating the economic viability and financial stability of the firm during the given time, the data in this financial statement is essential.

Lulu Enterprise completed the year with a net profit of £1,218. An overview of Lulu Enterprise's economic outcomes for 2022 may be seen in the income statement. The amount left over after subtracting all costs from gross profit is the net profit, sometimes referred to as the bottom line (Dinh and Schultze, 2022). Moreover, it also displays the business's earnings, costs, and expenses, which led to a total profit of £1,218. For evaluating the economic viability and financial security of the firm during the given time, the data in this statement is essential. The closing stock value is subtracted from the starting stock plus purchase total to get the cost of goods sold (COGS). COGS in this instance came to £2,387. The financial performance of Lulu Enterprise for the year 2022 summarised in this income statement.

In a changing world, technology for communication and information is essential and they are significant in many spheres of society, including finance, education, health care, politics, and private life. With the use of warning systems for emergencies, networks for communication, and data analysis, ICT facilitates catastrophe preparation and management. By guaranteeing that individuals in underserved or rural locations have access to data and amenities, ICT has the ability to close the digital divide. ICT has impacted how share information, work, study, and engage with the outside world in today's society.

The ability to advance innovation, increase productivity, and improve the standards of life while tackling global issues and fostering equitable progress is what makes it so significant. An enormous quantity of knowledge and data resources is instantly accessible thanks to the World Wide Web and digital libraries. Through increased audience reach, international collaboration, and online commerce, ICT helps firms to grow internationally. Furthermore, it makes performing data analysis, effective customer relationship management (CRM), and supply chain management easier.;

These distinctions emphasize how private limited businesses and public limited companies have varied traits and legal obligations, making each form ideal for certain business goals and degrees of ownership and investment. The common business entity types Private Limited Company and Public Limited Company generally have unique traits.

Limited Liability Company is held by a limited number of stockholders, frequently the company's founders, close relatives, or a few investments.

Public Limited Company with an adequate number of shareholders that is open to the public and whose shares are exchanged openly on the stock markets.

A private limited company must have no fewer than two of 2 and a maximum of 200 employees, and it does not have an initial public offering since its ownership interests are not sold on the open market.

The minimum number of members for a public limited company is 7, although there is no maximum number (Chien et al. 2021). The firm can go through the IPO procedure to become a publicly listed company and raise money from the general population's markets.

Private Limited Companies often do not need to have statutory meetings and are unable to exchange or sell shares freely absent the approval of the shareholders at present or the board of directors.

Shares of a publicly traded company are freely tradable on stock markets without the need for approval from other shareholders, and they are required to have mandatory meetings and submit a number of reports to regulatory organizations (Doherty and Kittipanya-Ngam, 2021).

A private limited corporation may not be required to post financial accounts for public review, has a smaller board of executives, and is subject to fewer regulatory restrictions.

Additionally, to preserve transparency for shareholders, public limited companies must adhere to stringent financial information and reporting standards. This often necessitates a larger board with additional statutory duties and directors who are autonomous.

Private Limited Companies are prohibited from issuing prospectuses to the general public and frequently do not have to maintain a minimum level of paid-up capital in many countries.

Before becoming public, Public Limited Companies may be required to have a sizeable minimum paid-up capital investment and may be able to submit an advertisement to the market for the subscribing of shares and the raising of money from the public (Taeihagh and Lim, 2019).

Accountants are essential to preserving organizational integrity, guaranteeing compliance with the law, and ensuring financial openness. However, because of complicated financial transactions, changing legal environments, and the pressure to achieve financial objectives, they face a variety of legal and moral problems and difficulties.;

Accountants could experience pressure from bosses or co-workers to sacrifice their moral standards in favour of corporate objectives. Accomplishing financial objectives can entail disregarding inconsistencies or using unethical tactics (Hamilton and Sodeman, 2020). Moreover, it is a constant struggle to balance giving in to outside pressure and upholding moral principles. Accountants regularly face difficult moral decisions that need considerable thought and moral judgment.;

In order to guarantee regulatory compliance and aid their organizations in achieving their business goals, accounting must strike an appropriate equilibrium. These competing objectives may result in ethical disagreements. For instance, it might be difficult morally to fulfil financial goals while abiding by accounting rules and laws (Karajovic et al. 2019). Accountants are responsible for preventing cyber attacks and data thefts and protecting sensitive finances, including personal data and a combination of bravery, a firm commitment to ethical ideals, and continual professional growth to meet these obstacles.

Auditors frequently feel pressure to keep customers, especially profitable ones. Due to this pressure, auditors may ignore or minimize serious accounting problems in order to keep a customer. Sometimes might be difficult to strike a balance between the necessity for moral auditing practices and the need to keep a client connection (?or?evi? and ?uki?, 2021). During audits, accountants serving in the capacity of auditors could discover financial irregularities. Making the option to report unethical behaviour within the organization can be challenging from an ethical standpoint.

In order to provide accurate and objective evaluations of financial accounts, auditors must remain independent and objective. When their companies offer other kinds of services to the same customers they audit, such as consultancy or tax guidance, they could, however, run into conflicts of interest. Their multiple roles may affect their objectivity and lead to moral quandaries.;

Earnings management is one of the biggest ethical problems in financial reporting. The upper ranks of the organization may put pressure on accountants to distort financial figures in order to hit immediate profit goals. This may result in actions like early revenue recognition, understating expenditures, or using extreme accounting techniques. Such actions may give a false impression of the organization's genuine financial situation (Pang and Lu, 2018). Sometimes might be difficult to identify what information is crucial and needs to be shared with stakeholders. Accounting professionals need to find a balance between the requirement for disclosure and the need to avoid bloating financial statements with unnecessary information. Subsequently, that can be unethical to withhold crucial information since it may cause stakeholders to receive inaccurate information and make incorrect judgements. In order to portray a more profitable financial image, accountants could be tempted to use these approaches, which can create moral conundrums concerning the truth and openness of financial reporting.

References;

Question. 1: Research paper analysis Rapid Assignment Help delivers excellence in education with tailored Assignment Help,...View and Download

1.0 Introduction - How Effective Is Pulmonary Rehabilitation In Improving The Quality Of Life Among Copd Patients? Say goodbye...View and Download

QUESTIONS Enhance your knowledge and skills with Affordable Online Assignment Help Experts, ensuring high-quality academic...View and Download

Task 1 Achieve academic excellence with Rapid Assignment Help, offering expertly written and affordable Assignment Help. Answer...View and Download

Question 1: Regulatory framework and financial reporting standards Make your assignments stand out with our...View and Download

QUESTION 1 Trust Rapid Assignment Help for detailed, accurate, and plagiarism-free Best Online Assignment Help, we provide...View and Download

Copyright 2025 @ Rapid Assignment Help Services

offer valid for limited time only*