Need help with assignment? Our expert writers provide top-quality assistance for all subjects, ensuring plagiarism-free work and timely delivery. Get professional guidance to boost your grades and academic success. Contact us today for reliable and affordable assignment help!

Business environment is defined as collection of all the external and internal elements such as customer needs and expectations, employees, management owners, social trends, economic changes, supplier’s supply and demand etc. In addition to this, the internal business environment is composed of the factors within the company which mainly includes management, current employees and corporate culture. All these elements have significant influence on firm’s operations and overall performance (ElNaggar and ElSayed, 2023). Along with this, micro business environment is described as atmosphere that exists within the business and can persuade the daily operations. On the other hand, macro environment is consisting of uncontrollable and external elements that influence the overall business operations and effectiveness (Ndalamba, Ndalamba and Caldwell, 2023). Every organization needs to analyse the business environment and evaluate the challenges facing by them. Effective evaluation of the business environment helps the organizations to recognize threats, enhances performance, creating opportunities and facilitates survival and growth. Apart from this, the report will be based on evaluation of business environment of TUI (Touristik Union International). This report will highlights the impact of increasing the corporate tax after Brexit on TUI’s internal, micro and macro environment.

Get assistance from our PROFESSIONAL ASSIGNMENT WRITERS to receive 100% assured AI-free and high-quality documents on time, ensuring an A+ grade in all subjects.

TUI is a global tourism leader offering hotels, cruises, and travel services. Post-Brexit, increased corporate tax rates negatively impacted TUI’s profitability, affecting internal operations, employee income, and market competitiveness while also supporting local tourism infrastructure.

TUI is one of the popular international tourism platform organizations. Its trade name is TUI AG. TUI is a public company and it was founded in 1923. The headquarters’ of this organization are situated in Berlin and Handover, Germany. This organization is comes under the hospitality and tourism sector. The portfolio of this organization is including 400 owned hotels, digital platform for more than 1, 60,000 tours, experience and activities. The chosen organization has 16 cruise ships, 1200 travel agencies and five airlines around 130 aircraft. This organization is popular in the world and it covers whole tourism value chain under one roof (TUI, 2024). To protect the environment, TUI is emphasising on environmental, economic and social sustainability. The selected company provide various travel and holiday services. The company’s businesses consisting touristic airlines, resorts, hotels, touristic airlines, cruise ships and tour operations.

In addition, this organization operates its hotel in key holiday regions under numerous brands such as TUI magic life, Robinson, suneo and blue. This organization offers the services of luxury cruises in the German-speaking countries and cruise ships in other indulgence markets. Additionally, this organization is operating its business operations within the wide number of countries such as UK, Germany, France, Netherland, Austria etc. The legal structure or leadership team of this organization includes executive boards comprises of group executive committe of 12 members, five members and supervisory board of 20 members (TUI, 2024).

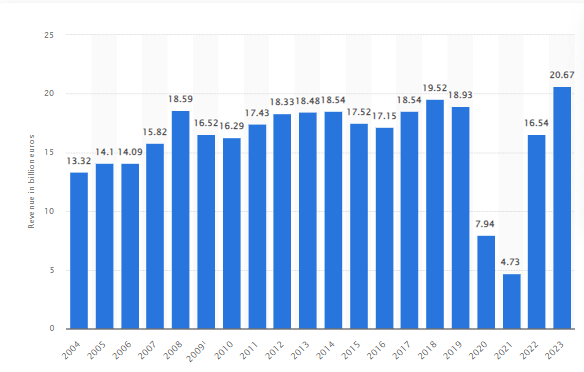

Figure 1: Revenue of TUI AG

Apart from this, in the context of size, the annual revenue of TUI is drastically increases since 2004. But in 2019, the revenue of this organization speedily decreases and reaches 7.9 billion euros from 18.93 billion euros due to COVID-19. But in 2022 and 2023 this organization is rapidly grow and it profits reaches to 20.67 billion euros (Statista Research Department, 2023). In 2023, this organization employed approx. 65.4 thousand employees. As of February 2024, the chosen organization has market capitalization of $3.85 Billion (TUI, 2024) https://companiesmarketcap.com/tui/marketcap/. The competitors of this organization includes Norwegian Cruise Line, Odenza Marketing Group, HIS, Norwegian Cruise Line Holdings. The organizational structure of TUI group is matrix that is based on the several elements of its core business.

TUI faces challenges from increased corporate tax post-Brexit, affecting profits and employee income. To recover, TUI can reduce costs, target new markets, and improve efficiency, enhancing profitability, customer engagement, and long-term business growth.

The internal environment of the business includes various number of contributing elements such as values, employees, organizational structure, physical assets, objectives and purpose. After brexit, the corporate tax rate was highly increases which have an immersive impact on the overall operation of the business. TUI faced a huge loss in its profits as one of the concern restricting from the circumstance. In all over the world, the tourist and travel companies hugely benefitted from the TUI’s presence. The increasing corporate tax impacts both negatively and positively the internal environment of the tourist companies (Aburumman, 2020). Higher tax can directly persuades the destination competitiveness within the market of tourism. However, high corporate taxes on the tourism related services make the destination less attractive to tourists because it increases the overall costs of travel. On the other hand, TUI provides financial support to the small companies and tourism infrastructure in vacation locations. This helps in major contributing to the protection of local tourism economy and also makes sure that it constantly thrives. High corporate tax also impacts negatively on the employees they will make less money. From this the partners or investors also get less money which ultimately negatively impacts the overall organizational goals and objectives (Coles, 2021).

It is crucial for the organization to recover the challenges that are face by them due to impact of increasing corporate tax on internal environment. Recovery of TUI’s profitability may be achieved by the use of internal atmosphere. It is going to be of excessive access to the business in terms of achieving its maximum potential and contributing to the long-term objectives and growth plan that are ambitious (Khoruzhy et al. 2020). By lowering the cost level the selected organization can increase the profitability that reduced due to increasing corporate tax. If the travel companies reduce the cost of travel then the tourists are more likely to visit the destination. To overcome the challenge the selected organization can also put emphasize on the market which helps in attract more tourists and ultimately positively impacts its profitability. It is crucial for the travel companies to overcome all the challenges in order to improve the overall efficiency and increase the growth of the business operations which ultimately positively impacts the overall profitability and customer’s engagement as well as experiences (MacLennan, 2020).

The micro environment factors consist of customers, investors, competitors, shareholders etc. The increasing corporate tax has massive impact on the micro environment of TUI’s. Due to increase of corporate tax after Brexit its customers were immersive impacted. Due to this, the company face the challenge of low customer engagement and experience. If the government increases the rate of corporate tax then the tourism business has to increase the price of tickets from which the tourists changed their plan or perception which ultimately negatively impacts on the daily operation of the business (Brinkman et al. 2014). Apart from this, the higher corporate taxes reduce the pay of workers from which they are prefer to switch the job which adversely impacts the overall management and daily operation of tourism business internally. If the employee turnover rate of TUI increases then it directly affects the overall efficiency and operation. Higher corporate tax has positive influence on the overall internal environment of TUI because it facilitates funding public services and increases the social welfare. This leads to build the strong relationships with the shareholders and positively impacts the long term sustainability (Yachin and Ioannides, 2020).

It is vital for the business to take corrective actions to combat the challenges that are face by impacting the micro environment from increasing the corporate tax. To increase the engagement and experience of the tourist TUI needs to provide better services to them from which they influence and take services repeatedly. It can be crucial for chosen business to attract the customers by reducing the cost of travel from which they probable to visit any place which positively impacts the overall profitability and efficiency of the business. Better visitors experience and satisfaction also helps tourism business to gain the competitive advantage over the competitors (Möller, Nenonen and Storbacka, 2020). Apart from this, to combat the challenge of higher employee turnover, TUI can require to make huge investment in the technologies to automate the process. If the business is adapting the technology then there is no requirement of hiring the human to automate the working operations. The latest and update technology helps the travel and tourism business to automates and streamline the complicated operations from customer services to logistics.

This document provides a PESTLE analysis of TUI, examining the external factors affecting its operations, including political, economic, social, technological, legal, and environmental influences. It highlights challenges such as high taxes, interest rates, and technological limitations, while suggesting strategies like automation and cost reduction to enhance efficiency and profitability in the tourism sector.

Taxes on the tourism related activities such as transportation, hotel stays, generate revenue for the government. The revenue can be utilized to fund public services, infrastructure development and foster the tourism itself with the help of marketing initiatives and campaigns. Corporate taxes on tourism can have the significant influence on the overall economy. In the context of external environment, the tourism industry helps in generating employment opportunities and contributing to the local economy. In addition to this, PESTLE factors have significant impact on the overall operation of TUI. The political environment includes several factors such as tax policy, political stability and key drivers to change etc (Sul, Chi and Han, 2020). In the context of tax policy, the visitors have major contribution towards jobs, sales, income, profits and tax revenues. The tax policy helps the tourism business to make sure that the nation implements the “right” policies in order to achieve the right goals. The economic factors include economic environment, economic growth, inflation rate, interest rate and exchange rate. Most of visitors are likely to take holiday loans and travel loans. If the bank rates are high then TUI face the challenge of the attracting of the visitors because they think twice before going on vacation.

In addition to this, social elements comprise the cultural and demographic aspect of external microenvironment. Some social elements connected with TUI include change in lifestyle, age distribution, safety, higher life expectancy. Due to put less emphasis on the technology, TUI faces the challenges of automate the process, enhancing the working operation and increase the profitability which ultimately negatively impacts the overall operations. The environmental challenges like global warming have managed the environmental protection law such as limits of carbon emission (Biryukov et al. 2020). To operate the operation effectively TUI implements all the legal rules and regulations related to travel & tourism.

It is significant for the tourism sector to recover from all the issues they are facing by using the macro environment. From the PESTLE it has been determine that TUI face the issue to visitor’s attraction due to higher bank interest rate and technological up gradation. To automate the process, the chosen organization has to implement the latest and updated technologies to provide better services to tourists that ultimately positively impact the overall profitability and efficiency (Gryshchenko et al. 2022). To reduce the pressure of vacation loan on the tourist the selected organization need to reduce the cost of travel.

Our business assignment help covers a wide range of topics, from finance and accounting to organizational behavior and international trade, ensuring your assignments are thoroughly researched and expertly written.

Conclusion

In the end, it has been summarized that after Brexit the corporate tax was rise so it significantly impacted the overall business environment of TUI. It can be crucial for the TUI to take the corrective actions to enhance its operation by recognizing the internal, micro and macro analysis. To enhance the overall operation the selected business is required to place more emphasis on the automation of the process by making huge investments in the latest and updated technologies. Adaption of this strategy can be useful for the tourism business to improve its operation because it helps in managing all the functions effectively and capability to connect potential visitors. Technologies help in improving the operation of TUI by reducing operational costs, enhance efficiency and free up the resources for innovation. Along with this, the chosen organization is also face the challenge of increasing the employee turnover so to recover this challenge it will require to focus implementing technologies to automate the process and there is no requirement of recruiting humans. The possible limitation of this strategy is requiring large amount of investment. Implementation of this strategy can be crucial for the business within the limited time to improve the operation.

References

Books and Journals

Online

1.1 Introduction - The Rise of Corporate Social Responsibility in Modern Business Get free samples written by our Top-Notch...View and Download

PART 1 Let Rapid Assignment Help simplify your academic challenges with professional Assignment Writing Help designed...View and Download

Introduction Enhance your grades with our premium-quality Online Assignment Help, carefully tailored to suit your learning...View and Download

1. Planning and Programming Effective supply chain management plays a crucial role in ensuring smooth project execution. From...View and Download

Chapter 1: Introduction Say goodbye to stress and hello to academic achievement with our trustworthy and student-friendly...View and Download

Introduction Trust Rapid Assignment Help for detailed, accurate, and plagiarism-free Assignment Help that caters to your...View and Download

Copyright 2025 @ Rapid Assignment Help Services

offer valid for limited time only*