+44 75754 30035 help@rapidassignmenthelp.co.uk

offer

🎁Special Offer 🎁 Discounts - Up to 55% OFF!

🎁Special Offer 🎁 Discounts - Up to 55% OFF!

This assignment will cover important attributes of accounting applicable for business where investment appraisal techniques and their associated viability will be illustrated. Fundamental priority of this assignment will be offered for evaluating usefulness and limitations of various investment appraisal methods while plausible recommendations for selection of a project will be offered subsequently. Analysis of potential resolutions for mitigating conflicts of NPV and IRR will be subsequently discovered in this assignment while impacts of cost of capital on net present value of each project will be detected in brief.

Enhance your finance assignments with Assignment Help UK, providing an in-depth evaluation of investment appraisal methods, time value of money concepts, and recommendations for effective project selection.

The usefulness of “accounting rate of return” mainly consists of being an easy calculative method for determining percentile returns that can be fetched if an investment is undertaken by a company. As viewed by Magni and Marchioni (2020), additional advantages of the “accounting rate of return” method also involves facilitation of easy investment decision making frameworks since complexities associated are minimal with this method.

Usefulness of the payback period method fundamentally involves allowing organisations the ability to detect the overall duration needed for an investment to recover its initial investment costs with available cash flows. Additional usefulness of the “payback period” method involves its calculative feature where the method is usually easier to be applied.

Usefulness of the “net present value” mainly include application of time value of money for determining discounting values of cash flow and to obtain expected returns that can be generated from an investment in currencies. As per explanations of Siziba and Hall (2021), usefulness of “net present value” also includes the method being the most plausible tool for investment decision making thereby allowing sensible and judicious decision-making facilities initiated by organisations.

Get assistance from our PROFESSIONAL ASSIGNMENT WRITERS to receive 100% assured AI-free and high-quality documents on time, ensuring an A+ grade in all subjects.

Usefulness of the “internal rate of return” method fundamentally involves consideration to percentile value of expected future returns that can be generated from an investment proposal. Additional usefulness of “internal rate of return” method also involves comparative characteristics where a project feasibility can be compared with cost of capital to decide selection or rejection of a specific investment project.

Our accounting assignment help simplifies complex accounting topics, providing detailed solutions that will improve both your understanding and grades.

Fundamental limitations of the “accounting rate of return” method involves lack of consideration for future risks since this method follows a symmetric and linear profitability approach. Additional demerits of this method involve exclusion of time value of money consideration where effects of economic influences cannot be evaluated.

The “payback period” method contains the primary limitation of not addressing percentile or monetary returns that can be obtained by an organisation when an investment appraisal is undertaken. Saługa et al. (2021), critically stated that disadvantages of “payback period” method also include exclusion of discounting applications where cash flows evaluated are primarily non-discounted.

Limitations of the “net present value” method are mainly associated with uncertainties pertaining to discounting rate and other economic factors. Wang and Lee (2021), critically opined that the NPV method of investment appraisal is also limited with providing currency-based returns and assessment of percentile returns cannot be fetched in this method.

Limitations of the internal rate of return method mainly involve non-consideration of time value of money thereby excluding discounting applications for cash flows. As Alkaraan (2020), critically narrated those additional limitations of the “internal rate of return” method include lack of offering currency-based returns since percentage values are only obtained in this method.

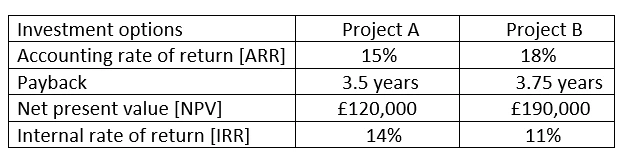

The above figure expresses superior “payback” and “internal rate of return” achieved by project A, while “net present value” and “accounting rate of return” for project B is deemed superior. The project selection criteria applicable for the company emphasises payback period method as the primary tool and hence project A should be chosen.

In order to mitigate conflict associated with project preferences based on differentiated NPV and IRR for project A and project B, primary emphasis is needed to be offered towards assessment of project selection criteria followed. The company mainly follows the project selection criteria of lower payback period in which project A contains a marginally better payback than project B. Based on this criterion, project A should be selected by the company since this project meets necessary criteria’s applicable for selection. Shaturaev (2023), stated that when project duration for available options is similar then potential resolutions for mitigating conflict between NPV and IRR should be met by prioritising “net present value” over “internal rate of return”. This is mainly followed since higher NPV of a project is deemed more feasible and allows a company the scope to maximise financial returns that can be obtained. Based on NPV priority, project B should be chosen by the company since it fetches a higher financial return as opposed to project A.

The impact of cost of capital on “net present value” of each project is mostly considered to contain an inverse relationship. As part of the inverse relationship, an increase in cost of capital is likely to decrease the “net present value” while a decrease in the cost of capital for each project is likely to raise “net present value”.

Conclusion

This assignment has discovered that project A should be chosen due to a relatively lower payback period achieved in comparison to project B. Limitations of investment appraisal techniques have also been conducted in this assignment where payback period and accounting rate of return are limited concerning application of time value of money. “Net present value” method and internal rate of return method are considered to be beneficial since accurate estimation of percentile and monetary returns can be detected.

Recommendations

Recommendations that additionally offered involve consideration to identify cost optimisation techniques if project A is to be undertaken. Application of cost optimisation techniques will offer the company scope to increase its profitability that can make the new investment highly attractive in financial terms.

Reference List

Introduction: The Internal And External Factors Which Impact Harrods Get free samples written by our Top-Notch subject...View and Download

Introduction Get free samples written by our Top-Notch subject experts for taking online Assignment...View and Download

Introduction to Financial Accounting of ASOS PLC Assignment Business Background The company ASOS plc was built in the year...View and Download

Introduction Struggling with research interviews? Assignment Help UK guides you through effective interview...View and Download

Introduction Get free samples written by our Top-Notch subject experts for taking the Assignment Assistance from Rapid...View and Download

Scenario for LO1 Introduction: HR Development Skills, SWOT, HPW & Performance Get free samples written by our...View and Download